News

IRS Releases HSA Limits for 2016

Posted 05.07.15

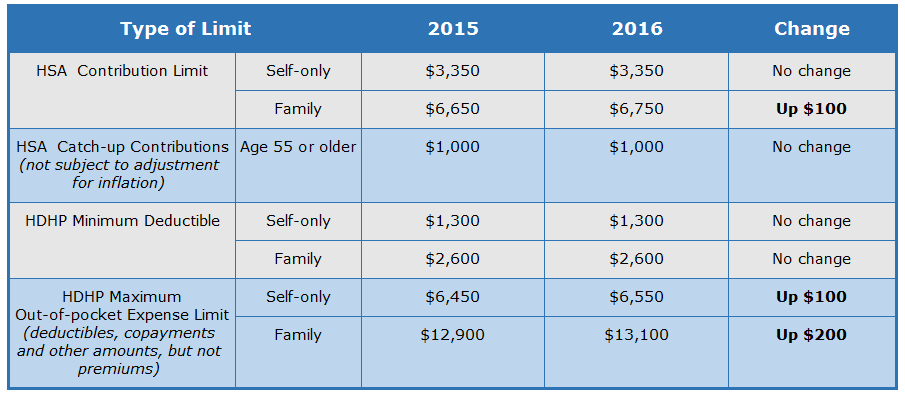

On May 4, 2015, the Internal Revenue Service (IRS) released Revenue Procedure 2015-30 to announce the inflation-adjusted limits for health savings accounts (HSAs) for calendar year 2016, addressing the following:

- The maximum HSA contribution limit;

- The minimum deductible amount for high deductible health plans (HDHPs); and

- The maximum out-of-pocket expense limit for HDHPs.

Only some of the HSA limits will increase for 2016. The limits that will increase are:

- The HSA contribution limit for individuals with family HDHP coverage

- The maximum out-of-pocket expense limit for self-only and family HDHP coverage.