News

2019 HSA Limits

Posted 05.14.18

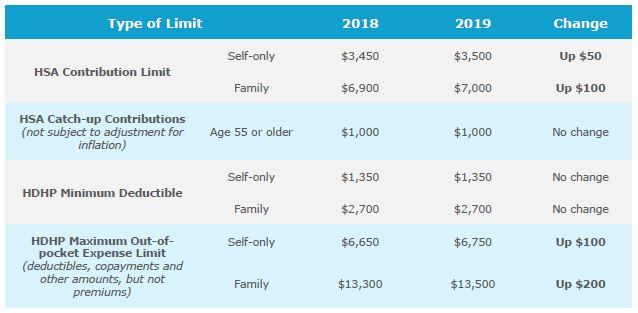

On May 10, 2018, the IRS released Revenue Procedure 2018-30 to announce the inflation-adjusted limits for health savings accounts (HSAs) and high deductible health plans (HDHPs) for 2019.

The adjusted contribution limits for HSAs take effect as of Jan. 1, 2019. The adjusted HDHP cost-sharing limits (minimum deductible and maximum out-of-pocket) take effect for the plan year beginning on or after Jan. 1, 2019.

The following chart shows the HSA and HDHP limits for 2019 as compared to 2018. It also includes the catch-up contribution limit that applies to HSA-eligible individuals who are age 55 or older, which is not adjusted for inflation and stays the same from year to year.

Contact your NEEBCo representative with questions.

IRS Announces HSA Limits for 2019