News

2016 Transitional Reinsurance Fees

Posted 09.06.16

The transitional reinsurance program is intended to help stabilize premiums for coverage in the individual market during the first three years of Exchange operation (2014, 2015 and 2016). The fees apply to plans that provide major medical coverage. This program imposes the fees on health insurance issuers and self-insured group health plans.

Who is subject to the fee?

The ACA requires “contributing entities” pay fees to support the reinsurance program. For the 2015 and 2016 benefit years, a “contributing entity” means a health insurance issuer or a self-insured group health plan that uses a TPA in connection with claims processing, adjudication or plan enrollment.

- For fully-insured health plans, the insurance carrier is required to pay reinsurance fees.

- For self-insured plans, the plan sponsor is liable for paying reinsurance fees. For a plan maintained by a single employer, the employer is the plan sponsor.

How much is the fee?

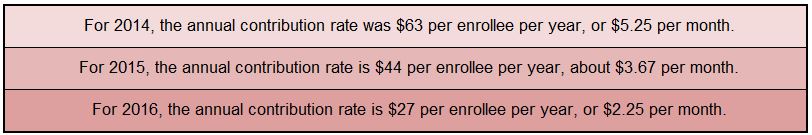

The reinsurance program’s fees are based on a national contribution rate, which HHS announces annually.

An issuer’s or plan sponsor’s reinsurance fee will be calculated by multiplying the number of covered lives (employees and their dependents) during the benefit year for all of the entity’s plans and coverage that must pay contributions, by the national contribution rate for the benefit year.

How is the “covered lives” count determined?

Contributing entities will use one of the following counting methods to calculate the number of covered lives of reinsurance contribution enrollees for a benefit year:

For self-insured plans, the TPA will assist in determining the covered lives count.

What is the employer responsibility?

For fully-insured employers, the insurance carrier will pay the reinsurance fees.

For self-insured employers, the employer will need to:

1) Register on www.pay.gov to establish an account (if not already established);

2) Register on www.REGTAP.info to access training presentations, tools and FAQ’s on:

- Completing the Transitional Reinsurance Program Annual Enrollment and Contribution Submission Form;

- Uploading the Supporting Documentation; and

- Scheduling payment of the fee;

3) Work with the TPA to determine the covered lives count; and

4) Decide to pay the Reinsurance Fee in one or two payments.

For more information

As part of registering on REGTAP, self-insured employers can take advantage of the training modules, scheduled for September 2016 and October 2016.

Contact your NEEBCo representative with any questions you may have on the Transitional Reinsurance Fee.