News

Health Plan Penalties Increase

Posted 07.07.16

On July 1, 2016, the Department of Labor (DOL) issued an interim final rule that increases the civil penalty amounts that may be imposed under various federal laws, including the Employee Retirement Income Security Act (ERISA). These increased penalty amounts reflect an initial catch-up adjustment effective August 1, 2016, and may apply for any violations occurring after November 2, 2015. The DOL will then adjust penalty amounts for inflation every year, beginning in January 2017.

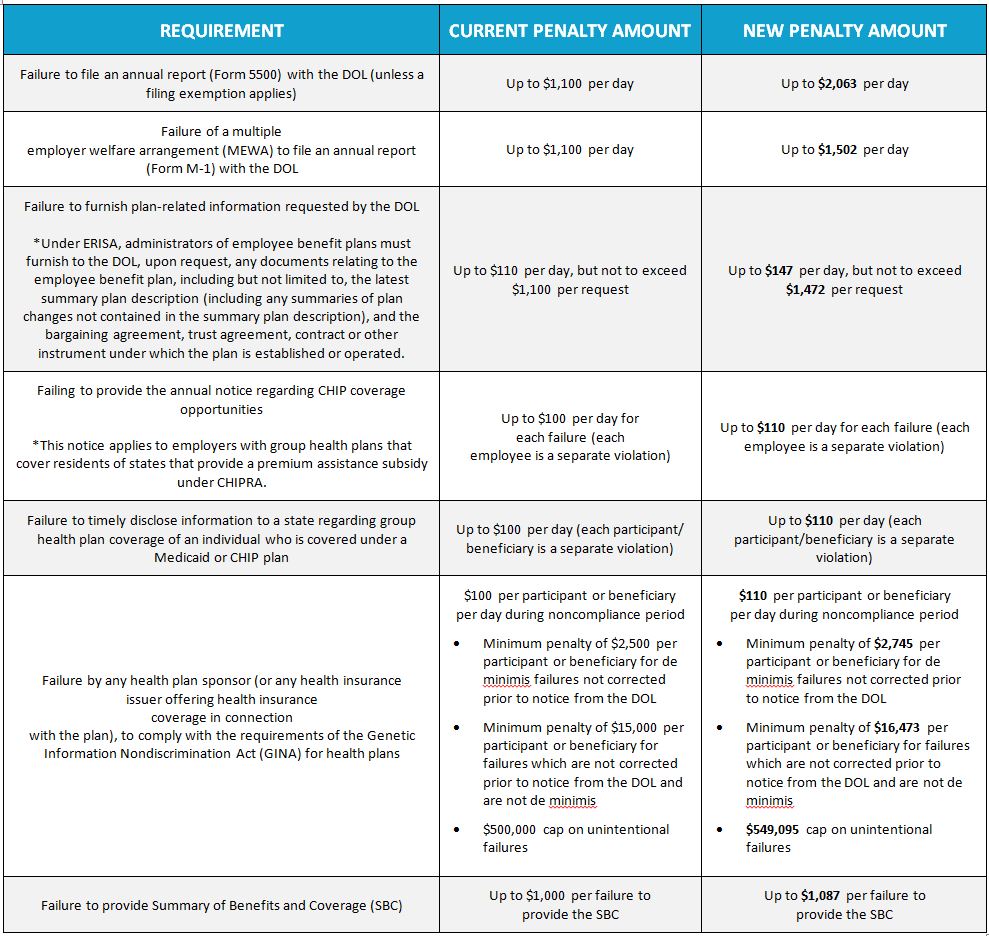

The updated maximum penalty amounts are shown in the table below.

Employers should become familiar with the new penalty amounts and review their health plans to ensure compliance with ERISA’s requirements. Contact your NEEBCo representative with any ERISA or compliance questions you may have.